Living on Bitcoin: A Better Money Strategy with Bill Pay

by Brandon - Lightning Pay Team

Updated June 17, 2025

There’s a moment that hits you when you start paying your bills with Bitcoin: I can actually live on this.

For many, Bitcoin is a savings asset, something you buy and hold long-term. But if you want to take the next step, if you believe Bitcoin is better money, the real question is: why not use it to pay for the things you already spend money on?

That’s where Bill Pay comes in.

With Bill Pay at Lightning Pay, you can pay any New Zealand bill using Bitcoin. Power. Internet. Rent. Insurance. It all works. And it opens up a powerful strategy: put your expected monthly expenses into Bitcoin at the start of the month, and live your life from there.

Why This Strategy Works

When I started paying my bills with Bitcoin, I realised I could push more of my financial life into sound money. Instead of holding NZD and converting only when needed, I flipped the model:

-

Each month, I move the amount I expect to spend on bills from NZD to BTC.

-

I sit on that Bitcoin balance for the month, and use it to pay bills via Bill Pay as they come due.

Because Bitcoin appreciates over time, I’ve found that more often than not, I end up with more purchasing power by the end of the month than when I started.

Is there volatility? Of course. But here’s the simple reality:

In 8 of the last 12 months, I’ve come out ahead.

Check out the monthly performance of bitcoin vs NZD below.

| Month | 2025 | 2024 | 2023 |

|---|---|---|---|

| January | 9.05% | 3.62% | 38.17% |

| February | -17.46% | 44.04% | 3.89% |

| March | -3.52% | 18.74% | 21.41% |

| April | 8.12% | -13.36% | 4.01% |

| May | 11.83% | 6.53% | -4.54% |

| June | -6.03% | 9.78% | |

| July | 4.59% | -5.01% | |

| August | -11.78% | -7.38% | |

| September | 5.24% | 3.31% | |

| October | 16.30% | 32.79% | |

| November | 38.50% | 2.71% | |

| December | 4.08% | 9.41% |

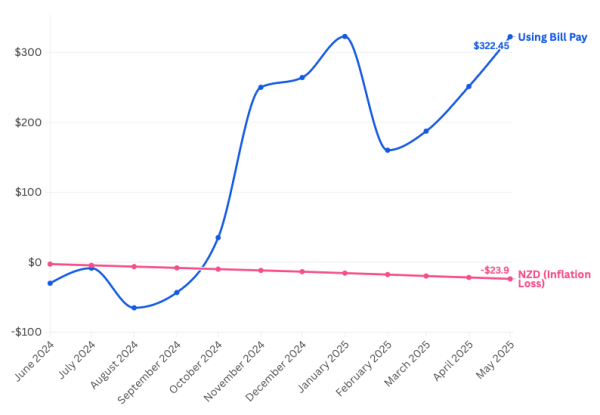

Sample Strategy: $1,000 Monthly Bills over 12 months

- On the 1st of the month, you convert NZ$ 1,000 to Bitcoin.

- Over the past 12 months, bitcoin's price appreciation has been 5% per month on average

- You use the Bitcoin balance to settle your bills—rent, utilities, insurance—as they come due throughout the month, spending a total of NZ$1000 in value.

- The estimate below assumes you're spending throughout the month, and only experiencing half of bitcoins price appreciation (or loss).

For the last 12 months, compared to holding these dollars in NZD, you've gained around $350 in value (~3% of the total spent), just for holding your value in bitcoin for an extra two weeks! Even accounting for the fact the first two months of this strategy netted a loss, the arrow of time and bitcoin appreciation wins.

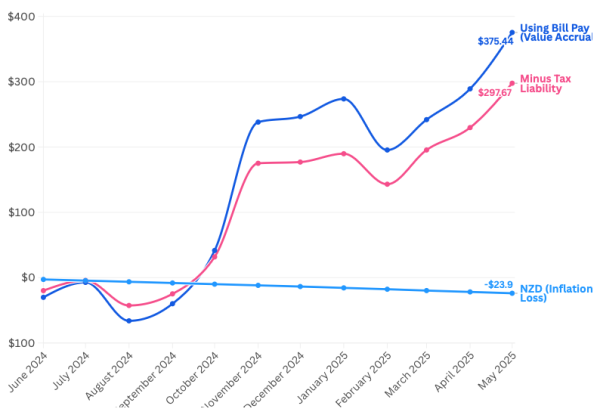

What about Taxes?

This is almost always the first objection to using your bitcoin this way. It's understandable, the tracking of your spending and calculations at the end of the tax year can be pretty frustrating.

In the end, I think this is just a judgement call. We try to make it as easy as we can to pull the data you need to calculate your taxes, but you have to do what's right for you.

What is certain is that this is only a problem if you're winning more than you're losing. So, what happens if we add taxes to our strategy? Well, if we remove the taxable part of our gains along the way, the outcome is impacted, but not as much as you might think.

Benefits of this Strategy

-

Live your values — if you believe in Bitcoin as better money, why keep your spending money in inferior money?

-

Stack smarter — instead of waiting to see what’s “left over” to save, you front-load your Bitcoin position.

-

Stay disciplined — you already know your fixed expenses; this strategy helps you automate your Bitcoin life around them.

How to Get Started

-

Add up your monthly bills you want to pay in Bitcoin. Think rent, power, phone, subscriptions, etc.

-

Convert that amount to BTC at the start of the month.

-

Pay bills as normal using Lightning Pay Bill Pay. Setup your payees in Lightning Pay just like you would in your bank, then use your Lightning wallet to pay instantly.

-

Track your monthly performance. Watch your purchasing power in real time. Over the long run, you may find you’re beating NZD simply by opting into better money more often.

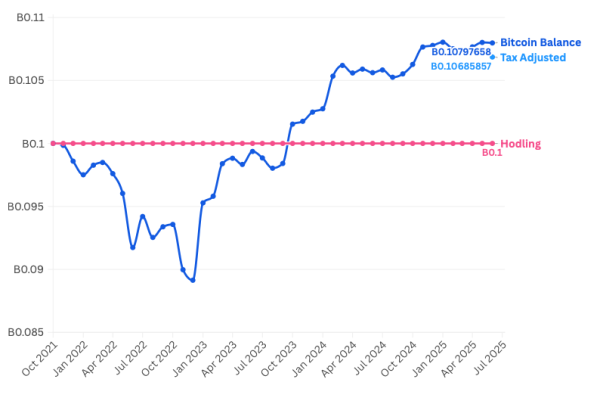

What If the Price Drops?

Short-term volatility is part of Bitcoin. But if you believe, like I do, that Bitcoin is superior money over the long haul, then this approach simply lets you spend more of your time denominated in bitcoin and win more often than you lose.

In bear markets, this strategy still has some merit. Yes, your bitcoin balance is reduced over time while the price is falling, but in the end, you'll recover and benefit from the positive months. Keep in mind, you can always stack more sats in the bear market too!

This is a scenario where you have 0.1 BTC stacked at the last all time high in November 2021, and continued spending it throughout the bear market (buying at the beginning of the month). This is just about the worst case scenario.

Interestingly, while the tax owed conducting this strategy still impacts the overall outcome, it has some positive benefits too. The unrealised tax liability on remaining on the 10.6M sats you have in your wallet, when you've been spending it along the way, is only $544. If you just held the 10m, your tax liability would be $2,914.

One More Thing: It Feels Good

There’s something satisfying about seeing your bills flow through a Lightning wallet. The payment experience is better! I'm often remarking to myself, "why can't all payments work like this?"

It’s not theoretical. It’s real. You can live on Bitcoin.

Start with your bills.