All Aboard!

The phrase “Nothing Stops This Train” is one of the biggest memes in bitcoin. It captures the sense that the global debt machine is barreling forward, defying the brakes we’ve traditionally relied on.

In her instant classic book: Broken Money, Lyn Alden shows that monetary systems evolve with technology. Each phase: gold, paper, fiat, and digital ledgers arose to solve constraints of the last. But today’s fiat system is straining under debt, deficits, and centralisation.

Enter: Nothing Stops This Train. Alden picked up the phrase in October 2023 and made it her meme for the unstoppable momentum of government debt, deficits, and monetary expansion. From then on, “Nothing Stops This Train” became shorthand for her thesis that the fiscal dynamics of the US (and much of the world) are beyond the point of being slowed by conventional tools like interest rate hikes or spending cuts.

Fun Fact! Do you know where the phrase originally came from? It didn’t start in finance. The line comes from Breaking Bad (Season 5, Episode 4 named “Fifty-One”, from 2012), where Walter White declares “Nothing stops this train” in reference to his drug operation’s insatiable need for a particular ingredient… Remind you of anything?

Why the train is unstoppable

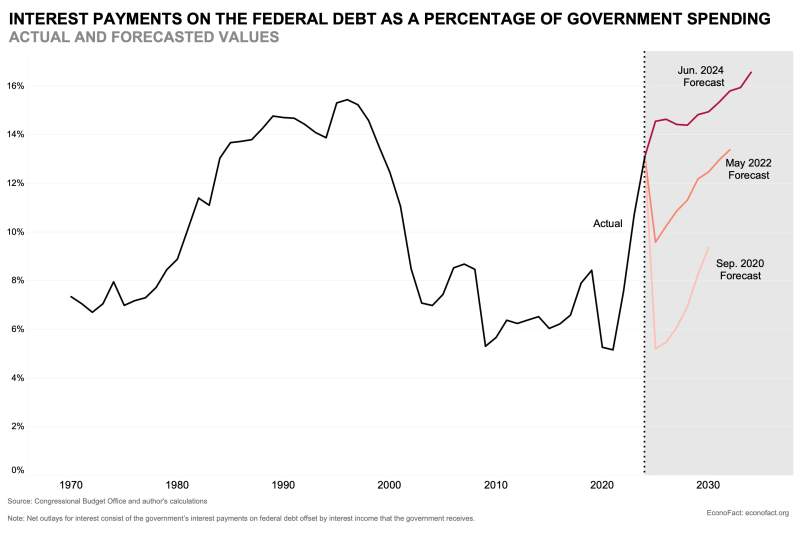

The train metaphor is a way of describing fiscal dominance: when debt and deficits drive policy more than central bankers do. Raising rates to fight inflation, for example, only makes government borrowing costs balloon, feeding the problem rather than fixing it.

Under this setup:

-

Monetary policy loses independence

-

Debt service crowds out budgets

-

Inflation risks become structural

-

Currency debasement becomes harder to avoid

We’re seeing this in action today – in 2024 the United States spent more on debt financing costs than on defence. Meanwhile the Federal Reserve is reducing interest rates despite sticky inflation.

The “train” is government debt and deficits. Once a country passes a certain point, the maths just stops working the way it used to:

-

Debt snowball: When interest rates rise, so do the government’s interest payments. Instead of slowing borrowing, rate hikes increase the deficit – forcing more borrowing.

-

Political gravity: Cutting spending or raising taxes enough to fix the problem is politically impossible. Voters punish austerity, so leaders kick the can forward.

-

Structural promises: Most government budgets are locked into entitlements, healthcare, pensions, and defence. These are non-negotiable commitments that automatically rise with demographics and inflation.

-

Global coordination: Because many major economies (U.S., Europe, Japan) are on the same track, there’s no external brake. Everyone is running large deficits at once.

That’s why Lyn Alden says “nothing stops this train.” Once the cycle of debt → higher interest → bigger deficits → more debt is in motion, it feeds itself. The brakes we normally think of: rate hikes, spending cuts, “discipline” either don’t work anymore or make the problem worse.

Stop the train I want to get off!

So, governments are addicted (or simply obligated) to spend more than they earn, while the costs of those obligations increase with the money supply. There’s no good way back to being on the rails.

Her “Nothing Stops This Train” meme is the lived reality of that system: the momentum of government spending and borrowing has become so entrenched that traditional brakes don’t work.

That is exactly where Bitcoin comes in.

-

Scarce: Bitcoin’s supply is fixed, immune to the endless expansion that drives fiat fragility.

-

Decentralised: It cannot be bent by fiscal dominance or captured by policy constraints.

-

Digital-native: It fits the technological trajectory Alden describes – a money suited to instant communication and global networks.

-

Optionality: Bitcoin provides individuals, businesses, and even nations a parallel rail outside the fiscal train, a hedge against systemic overreach.

Alden’s point isn’t just that fiat is “broken.” It’s that when the fiscal train has no brakes, you want an exit ramp. Bitcoin is that exit.

I choo, choo, choose bitcoin.

Nothing Stops This Train is a clever way to frame the situation the financial systems find themselves in. It conveys the gravity of the situation using a clear and easily understood metaphor for what can be a fairly complicated set of problems and implications. At the end of the day, government costs are in an unstoppable upwards spiral. The toothpaste is out of the tube on spending, printing, inflation, and debt. You can stay on the train, until it derails, or you can be like Todd above and jump off the moving train…